Alternative Assets: A Quick Overview

Triston Martin

Mar 05, 2022

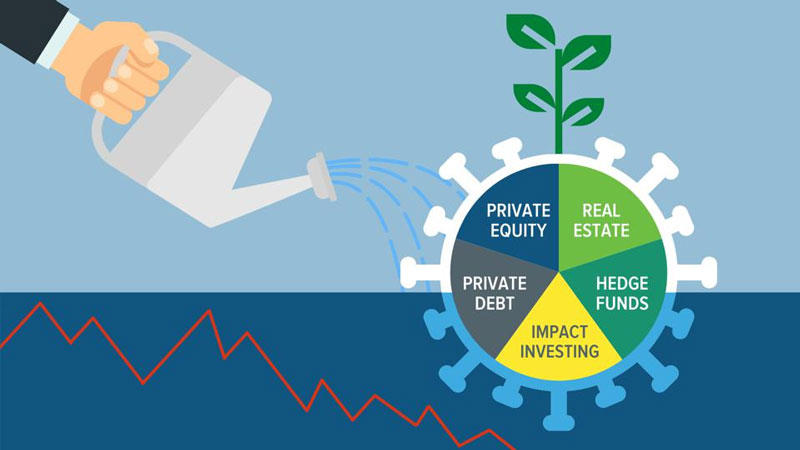

Put another way, "alternative assets" are investments that don't fit neatly into any of the other asset classes that most investors are familiar with. It is possible that these assets are less liquid than their traditional counterparts and may require a lengthier investment time before any significant value is realized.

Investment Types: Traditional vs. Alternative

Publicly traded investments like stocks, bonds, and cash are considered traditional investments. Public markets, such as the FTSE, NYSE, and SSE, are the conventional venues for corporations to offer their stock to the general public.

Financial regulators such as the SEC (Securities Exchange Commission) or the FCA (Financial Conduct Authority) oversee these forms of investments (Financial Conduct Authority). A financial asset known as an alternative investment does not fit neatly into the three classic investment categories: stocks, bonds, and real estate.

Alternative investments are difficult to understand and are not subject to much regulation. As a result, institutional investors and accredited high-net-worth individuals hold the majority of alternative asset investments.

Private markets are typically opaque because of their lack of oversight. These assets can be difficult to track down because private corporations aren't legally obligated to publish earnings or financial information.

Preqin's mission is to offer transparency and enable understanding across alternative assets by providing comprehensive data and best-in-class analytic tools to the market.

Investing In Diversified Portfolios: A Primer

Institutional investors or high-net-worth individuals own most alternative investment assets because of their complexity, lack of regulation, and degree of risk. Many alternative investments' minimum investment and cost structures are higher than mutual funds and exchange-traded funds (ETFs).

On the other hand, these investments don't have much opportunity to publicize their results and attract new investors. Transaction costs associated with alternative assets are often lower than conventional assets because of lower turnover.

Compared to their conventional counterparts, most alternative assets are a lot less liquid than their traditional counterparts. If you want to sell a bottle of wine that's been sitting in your cellar for eight decades, you're going to have a hard time finding a buyer.

Due to the rarity of assets and transactions involving them, investors may find it difficult to value alternative investments. Due to its rarity and the fact that only one 1933 Saint-Gaudens Double Eagle $20 gold coin can be lawfully held, it may be difficult for a seller to determine the coin's value.

Investing In Alternative Asset Classes

The link between alternative investments and traditional asset classes is often minimal. Since the stock and bond markets have low correlations, commodities often move in the other direction. As a result, they make good additions to a diversified portfolio. A hedge against inflation is also provided through hard assets such as gold, oil, and real estate investments.

Hedge funds and other alternative investments account for a modest percentage of the portfolios of many large institutional investors, such as pension funds and private endowments.

Alternate investments are also available to the non-accredited individual investor. Alternative mutual funds and ETFs, sometimes known as "alt funds" or "liquid alts," are now accessible.

These alternative funds offer a wide range of investment options previously unavailable to the average investor. The Securities and Exchange Commission (SEC) has licensed and regulated alt funds traded on the stock market.

How Do Alternative Investments Differ From Other Forms Of Investing?

The fees and minimum investments for alternative investments tend to be higher than those for retail mutual funds and ETFs. Low transaction costs and the difficulty of obtaining reliable financial data for these assets make them more attractive. In addition to being less liquid than conventional securities, alternative investments may be difficult to value because they are so little traded.

For Investors, How May Alternative Investments Benefit Them

The minimal correlation between alternative investments and the stock and bond markets attracts some investors because they believe their assets will hold their value even during a market slump.

Hard assets like gold, oil, and real estate are also effective inflation hedges. Alternative investment vehicles are becoming increasingly popular as a means for huge institutions like pension funds and family offices to increase the diversification of their portfolios.

What Are The Rules And Regulations That Govern Alternative Investments?

Regulators for unconventional investments are less clear than those for more conventional securities. The SEC regulates alternative investment vehicles, although their deposits are not registered. This means that most investment vehicles are only open to institutions or rich investors.

Alternative Investing Characteristics

Almost all alternative investments have the following characteristics that differentiate them from traditional investments:

1. Traditional Investments Have A Low Correlation

Because of the low correlation, this could be extremely beneficial to potential investors, who can use it to diversify their portfolios.

2. It Is Difficult To Determine The True Value

When it comes to valuing alternative investments, it can be not easy. Alternative investments may require specialized knowledge, and the demand patterns of some assets like fine art may be difficult to predict. As a result, it can be difficult to value them because they may be unique.

3. Liquidity Is Extremely Low

Compared to traditional investments, alternative investments are typically less liquid. The lack of centralized markets and the lack of demand for some assets can explain the low liquidity (think about works of contemporary art). In addition, there are restrictions on when you can get out of some of the investments.

4. Inexpensive Goods And Services

There are often high costs associated with alternative investments. For example, some hedge funds have a minimum investment requirement and a fee.