Reverse Stock Split: A Complete Guide

Triston Martin

Mar 04, 2022

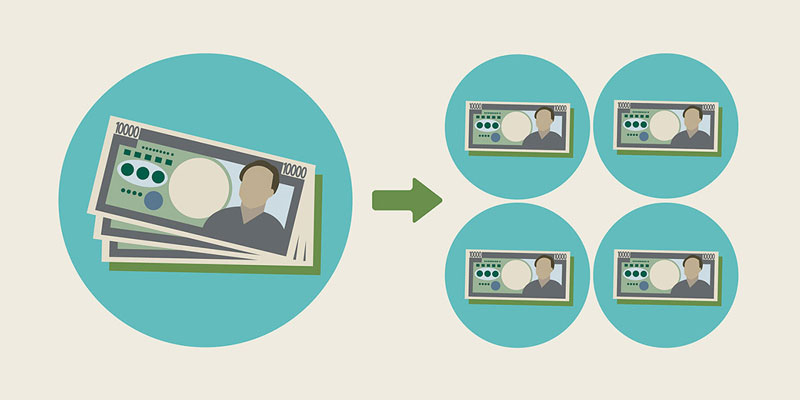

Several business acts may impact a company's capital structure, depending on market developments and circumstances. In a reverse stock split, existing stock is effectively combined to create a lesser number of proportionally more valuable shares.

The price per share rises due to a decrease in the number of shares held by a company. Firms mainly use reverse stock splits to increase the per-share price, and the accompanying ratios can range from one-for-two to one-for-100.

Reverse stock splits have little effect on the value of a company, even though they are frequently the result of the stock's value plummeting significantly. Such an act might be detrimental to the stock because of its negative connotation, which leads to increased selling pressure.

Using Reverse Stock Splits: Pros and Cons

A corporation can reduce its share count in the market for various reasons, some of which are beneficial.

Advantages

- The share price may have fallen to record lows, making it exposed to increased market pressure and other undesirable occurrences, such as a failure to meet the exchange listing requirements.

- A stock must meet a minimum bid price to be listed on an exchange. When a stock's bid price drops below this barrier and stays there for an extended period, it faces delisting.

- After being delisted from a national exchange, relegation to penny stock status necessitates the company's shares being listed on the OTCBB or pink sheets. After being listed on these low-value stock exchanges, the shares become more challenging to buy and sell.

- Institutional investors and mutual funds are wary of investing in stocks with a price below a specific minimum value; therefore, companies resort to reverse stock splits to keep their stock prices high. Even though a firm is not at risk of being delisted by the exchange, its trading liquidity and reputation are damaged if such large investors do not qualify for purchase.

- To satisfy regulators, a company's regulation is based on various variables, including the number of shareholders. When a company aims to limit the number of shareholders who fall within the jurisdiction of a specific regulator or set of regulations, it may reduce the number of shares available. Companies wishing to go private may also attempt to reduce the number of shareholders.

- The creation of a spinoff, a new company formed by the sale or distribution of new shares of an existing business or division of a parent company, may also benefit from reverse splits.

- There are times when it may be challenging to price spinoff business shares at a higher price while the parent firm's stock is selling at a discount. It's possible to fix this problem by reversing the share split and boosting the value of each share.

Disadvantages

Reverse stock splits are generally viewed as unfavorable by investors. Trying to raise the stock price artificially is a sign that its management has no real business plan to back it up. Additionally, a reduction in the number of shares in the open market could hurt the company's liquidity.

A Reverse Stock Split Is Conducted for Several Reasons

Shares that have fallen below a specified price threshold and are therefore at risk of being delisted from an exchange are typically reverse splits. For some investors, penny stocks may not be a viable option because of their low market value.

In The Event Of A Reverse Stock Split, What Will Happen To My Shares?

As the number of shares held by shareholders of record is decreased, the price of each share rises similarly. It is possible to possess 100 shares for $50 each after a reverse stock split, for example, if you had 1,000 shares before the split at $5. Because your broker does this automatically, you don't have to do anything. Tax consequences of a reverse split are nonexistent.

How Do You Feel About Reverse Splits?

As the share price drops dramatically, reverse splits are often perceived unfavorably and may even put the company at risk of being delisted. Following the split, some retail investors may find the higher-priced shares less appealing since they prefer companies with lower sticker costs.

An Applied Case Study

AT&''T Inc. (T), the largest telecommunications firm in the United States, reversed its stock split in April 2002 by a factor of five in preparation for the separation of its cable TV subsidiary and the subsequent merger with Comcast Corp. (CMCSA).

As AT&''T feared that the spinoff would impact its share price, liquidity, business, and ability to raise finance, the corporate action was prepared.

Numerous small, frequently loss-making R&''D enterprises with no marketable or profit-generating products or services regularly reverse their stock splits. In certain circumstances, corporations are forced to take this corporate action to keep their stock exchange listing.